By Kyle Taylor Lucas

The Affordable Care Act (ACA), signed into law in 2010, became effective January 2014. Many questions continue to roil in the minds of American Indians about just what the new health care law means to them.

The law helps make health insurance coverage more affordable and accessible for millions of Americans, including American Indians. Importantly, the law addresses inequities, increases access to affordable health coverage and prevention medicine for tribal members. The ACA is important to American Indians because it provides greater access to care and coverage unmet by the Indian Health Service (IHS).

The ACA requires all Americans to have health care insurance coverage. However, American Indians and Alaska Natives have the option to file a lifetime exemption. They are encouraged by the state Health Care Exchange to file the exemption regardless of their current insurance status in case their insurance should ever lapse.

There are numerous state and federal agencies working to implement and manage ACA health care delivery. Tulalip members can most directly obtain enrollment process advice from clinic staff members who have received specialized training as Tribal Assisters. They can help members through the enrollment process and refer you to a broker who is licensed to provide information and advice on qualified health insurance plans and policies. Tulalip Resource Advocate, Rose Iukes, has received intensive training on the ACA. She and Brent Case can answer questions and help enroll members. Fortunately, for Tulalip members, the Board of Directors contracted with a licensed broker, Jerry Lyons, to assist members in understanding and selecting the best-qualified health insurance plan for themselves.

Contact Information:

Tribal Assisters:

Rose Iukes, Resource Advocate – (360) 716-5632 / RoseIukes@tulaliptribes-nsn.gov

Brent Case, Resource Specialist – (360) 716-5722 / BCase@tulaliptribes-nsn.gov

Broker:

Jerry Lions, American Senior Resources – (206) 999-0317

Asked about the greatest impediment to enrolling tribal members, Rose Iukes said many tribal members assume IHS coverage is sufficient, so have been disinterested in the ACA. Even so, she noted, “We had almost 800 people apply. We got probably about 250 on qualified health plans and about 150-180 on Apple.” She said efforts were hampered by the state system “going down,” which required many tribal enrollments to be done in-person. “There were so many flaws that we started having people do paper applications here at the clinic. Now, we need to have them do follow-up. We didn’t get to do a test-run on the site. We thought we could go in and enroll them, but there were additional security questions. So, now we’re asking members who completed paper applications to come in and complete their application processes.”

Even with the challenges, Washington State fared better with its overall ACA rollout than other states, leading the nation in early enrollment numbers.

Rose Iukes noted significant confusion due to the state’s failure to provide clarifying information on special tribal provisions and exemptions on its websites and call centers. She said, “I’m hoping these call centers get educated on the tribal provisions and exemptions.” She could not say why there is little detail about income, age and other special provisions posted on state websites. Publicizing details of special federal poverty level provisions and exemptions for tribal members may be confusing to the general public. The result is that the rollout for American Indians, especially urban Indians without easy access or even referral to a Tribal Assister, has been challenging. However, despite the state’s system inadequacies, Iukes praised the American Indian Health Care Commission staff and Sheryl Lowe at the Washington Health Care Exchange whose support she felt was invaluable.

“The bottom line for tribal members, if they have ACA health care they can be taken care of. And they can get the help they need. That’s what drives me and why I advocate the way, I do. I don’t want somebody to go through the heartache,” said Iukes.

Tribal members often inquire about alcohol and chemical dependency treatment options, especially as many have a history of unsuccessful treatment attempts. Iukes said that beyond the Tribe’s one treatment option, “With qualified health plans, there is unlimited treatment, but we need to find a way to help them pay their premium. For example, a young man was ready to go to treatment, but his premium was $4. It must be paid with a debit card, but he didn’t have one. Ultimately, he didn’t go to treatment. I’ve asked the Board about setting up a way for the premium to come out of per capita, then we can issue them a card to use” to pay their premiums.

Broker, Jerry Lyons, is licensed with eighty (80) different insurance companies said, “In my brief time working with Tulalip, we feel confident in our efforts. We are being successful as we have been instrumental in assisting members with questions and we have enrolled more Native Americans into the ACA than any other tribe.” He added that never in his career has he been involved in a more “disorganized” insurance roll-out, but emphasized it was not due to the tribal efforts, but rather the bureaucracy. “Even so, we have helped about 250 people obtain insurance in one way or another.” Asked if he is available to all members many of whom reside off-reservation, Lyons replied, “We assist all members. There are also many special plans that most tribes are unaware of. Just have them call me.”

Several state, public/private, federal, and non-profit organizations are supporting tribal ACA implementation and enrollment. They are the Washington Health Benefit Exchange, the Health Care Authority, the Centers for Medicare and Medicaid Services (CMS) Region 10 office in Seattle, and the American Indian Health Commission.

Washington Health Benefit Exchange (HBE)

The Washington Health Benefit Exchange was created in 2011 state law as a “public-private partnership” separate and distinct from the state. The Exchange is responsible for the creation of Washington Healthplanfinder–the online marketplace to assist Washingtonians to find, compare, and enroll in qualified health insurance plans.

Many tribal members who rely upon IHS for their health care needs question the need to apply for ACA coverage. They also question the need to go outside treaty guaranteed health care services. Unfortunately, as most trust responsibilities, health care for American Indians/Alaska Natives has been historically and woefully underfunded and continues to be so today.

When asked why the ACA is important to tribal members, Sheryl Lowe, tribal liaison with the Washington Health Benefit Exchange, said, “Individual coverage offers tribal members more access to specialty care and even if the member uses their own tribal clinic, the tribe can then bill the health insurance company rather than the Indian Health Service. She emphasized that the basic tribal contract dollars can then be utilized for other urgent and uncovered care.

Lowe said the ACA benefits both individuals and tribes. “For most tribes, IHS only provides direct care and tribes have to pay Contract Health Care. And the IHS continues to be funded at less than fifty percent of need, so the ACA is another way for individuals and tribes to access health care. Also, most tribal clinics are Priority One clinics offering basic care and provide referrals only for life and limb.”

After working out many of the bugs and training, there are 93 Tribal Assisters, at least one in each of the federally recognized tribes in Washington, the state and the Tribal Assisters are now able to focus upon a more comprehensive effort to enroll tribal members. Lowe praised the Tribal Assisters who she credits with outstanding efforts to learn a complicated enrollment process to become certified as Tribal Assisters. She said Tulalip has four Tribal Assisters and she exclaimed, “Rose Iukes is so dedicated!” The HBE shared the following statewide training statistics:

– HBE-Certified Tribal Assisters: 93

– Tribal Staff in the process of becoming Certified: 34

– 66 Active Tribal Assisters helped 10,000 people enroll through the HPF (through 2/15/14)

– Tribal Assisters represented 25 Tribes, 2 Urban Indian Organizations, and SPIPA

The Health Benefit Exchange reports that statewide, of the 26,378 who answered “yes” to “Are you an American Indian/Alaska Native [AI/AN]?” on the ACA enrollment site, 21,201 of “enrolled tribal members” have enrolled in the Healthplanfinder. Significantly, 17,350 enrolled in Washington Apple Health (expanded Medicaid). Unfortunately, of the 3,885 AI/ANs eligible for Qualified Health Plans, only 1,110 actually enrolled even though many would likely have zero to low premiums and no cost shares.

Lowe said she couldn’t emphasize enough the importance of tribal members considering enrollment because those whose income falls in 138 – 300 percent of federal poverty level have no cost-sharing which means no co-pay or deductibles, “which is a huge benefit.” She added, “Depending upon household size and other factors, some may even have a premium that is zero. They can take the tax credit to lower their monthly premium or take it at the end of the year. Those in the 138 – 400% of poverty level are eligible for premium tax credits. Depending upon income or household size you can get tax credits which will reduce your overall costs.” She pointed out that some plans have deductibles for $5000 for a family before they’ll pay anything, so the cost-sharing benefit is one of the biggest things for tribal members.” It is clearly worthwhile for tribal members to speak to a tribal assister and/or broker.

Those whose income is below 100 – 138 percent of federal poverty level qualify for expanded Medicaid or Apple Health as it is now called. However, children are eligible for Apple Health in households whose income is up to 300% of the federal poverty level. Therefore, although the adults may not qualify for Apple Health, it is important to consider that children may.

Unlike Apple Health, the Qualified Health Plans do not provide dental. Yet, the ACA does require that all children be covered by dental insurance. The HBE indicates there are two low-cost children’s plans available. Sheryl Lowe indicates there is also discussion about the potential of adult dental plans to be introduced in 2016. Broker, Jerry Lyons, encourages tribal members to ask him about low-cost and special plans that most tribes are unaware.

Washington Health Care Authority (HCA)

The HCA oversees Washington expanded Medicaid or Apple Health plan for low-income residents. Washington is one of 27 states implementing expanded Medicaid. Of the many benefits for American Indians from the new health care law, expanded Medicaid seems most significant. Eligibility for Apple Health (expanded Medicaid) is the same for tribal members and the general public–that is household income below 100 – 138 percent of the federal poverty level. Tribal members in the Apple Health Program would not be eligible for tax credit that is offered tribal members in the Qualified Health Plans. However, one important benefit is that effective January; dental coverage for adults was restored.

Through expanded Medicaid in Washington, countless low-income American Indians and Alaska Natives can now receive specialty care. As of March 25, 2014, of all who identified as AI/ANs at enrollment, 17,350 have enrolled in Washington Apple Health (or expanded Medicaid). Staff at the Tulalip Tribes health clinic is working to update Tulalip enrollment numbers. Rose Iukes reported it is difficult because many are in process of updating enrollment after the glitches in the state system caused the Tribe to revert to paper applications.

Tribal members can enroll monthly by the 23rd, and then the plan starts the first of next month.

Big changes in Medicaid/Apple Health became effective January 2014. Because of the ACA, more people are able to get preventive care, like check-ups and cancer screenings, treatment for diabetes and high blood pressure, and many other health care services they need to stay healthy.

Apple Health (Medicaid) Benefit Changes Effective January 2014

Dental Services for Adults: Dental health benefits were restored for individuals 21 years of age and older in January. Ensure that your dentist is enrolled as a Medicaid provider.

Mental Health Services Unlimited Number of Visits: Beginning in 2014, there are no limits on the number of visits for mental health services in a calendar year.

Expanded Pool of Licensed Providers: Previously, psychiatrists were the sole mental health provider approved for adults, but effective January 2014, mental health services can be sought from a variety of providers. Coverage is expanded to services by Licensed Advanced Social Workers, Licensed Independent Social Workers, Licensed Mental Health Counselors, Licensed Marriage and Family Therapists and Psychologists. Just ensure your provider is enrolled with Medicaid.

Preventative Care Shingles Vaccine: Beginning January 2014, Apple Health shall will cover the shingles vaccination for clients 60 years of age and older. Age 60 or older is considered the most effective time to receive the vaccine.

Oral Contraception: Effective 2014: Apple Health now allows eligible clients the option to fill birth control prescriptions for a 12-month period.

Early Intervention Screening for Substance Abuse: Apple Health will cover services provided by trained, certified medical providers who conduct screening, brief intervention, and referral for treatment for individuals who may present as facing challenges with substance abuse, including alcohol, drugs and tobacco.

Screening of Children for Autism: Funding has been approved so that Apple Health’s enrolled primary care physicians can screen your child, if they are under three years of age to assess for autism.

Licensed Naturopathic Physicians serving as Primary Care Doctors: Beginning in 2014, licensed naturopathic physicians are able to provide primary care services. Given there are a limited number of primary care physicians, individuals possessing a Washington Department of Health Naturopathic Physician license shall be able to provide care in the scope of care outlined by Department of Health, including diagnosing, administering vaccines and immunizations, provide referrals to specialists, conduct minor office procedures, and write limited Food and Drug Administration-approved prescriptions.

Vendors that Provide Wheelchairs and Accessories: In 2014, Apple Health will provide coverage of wheelchairs and accessories from vendors Medicare certified to provide Complex Rehabilitation Technology items.

Centers for Medicare and Medicaid Services (CMS) & Indian Health Care (IHS)

The federal CMS has a Region 10 office to assist tribes with questions about expanded Medicaid and Medicare services. They were unable to be reached for comment. Per the CMS website statement, “Within the vast reforms in PPACA, AI/AN populations will be affected not only by the general provisions, but through specific, explicit provisions, including the permanent reauthorization of the Indian Health Care Improvement Act.”

A question unanswered by both CMS and IHS is how the federal trust responsibility intersects with tribal elders no longer qualifying for expanded Medicaid or Apple Health once they reach age 65. The Washington Health Benefit Exchange is attempting to secure answers to the inquiry. Ideally, those elders would be covered by treaty guaranteed programs created through IHS in their federal trust responsibility and expanded Medicaid that continues beyond age 65.

Though the IHS did not respond to questions about its continuing federal trust responsibility for tribal health care, according to its website, IHS states “it will continue to provide quality, culturally appropriate services to eligible American Indians and Alaska Natives.” Both the CMS and IHS websites also point to the ACA as benefiting Indian elders with strengthened Medicare, affordable prescriptions, and free preventive services regardless of their provider.

The IHS website notes that if tribal members buy private insurance in the Health Insurance Marketplace, they will not have to pay out-of-pocket costs like deductibles, copayments, and coinsurance if their “income is up to around $70,650 for a family of 4.” The IHS assures members of federally recognized they are eligible to continue receiving services from the Indian Health Service, tribal health programs, or urban Indian health programs even if they have obtained insurance in the marketplace.

The Native American Contact (NAC) for CMS Region 10 is Deborah Sosa. Deb is the agency’s main contact for questions or clarification on:

- health policies related to the Medicare, Medicaid, and CHIP programs

- policies and programs under the Affordable Care Act, such as the new health insurance exchanges/marketplaces, and

- emerging health policies and issues that arise in your community.

She can be reached directly at Deborah.Sosa@cms.hhs.gov or by telephone at (206) 615-2267.

Basic ACA Details for Tribal Members

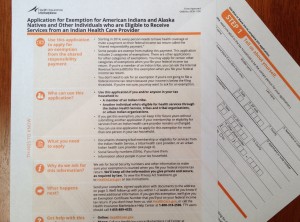

Exemption

American Indian and Alaska Native consumers who are members of federally recognized tribes have access to a Tribal Membership Exemption from the shared responsibility requirement payment. The exemption applies to American Indian and Alaska Natives who are members of federally recognized tribes and are unable to maintain minimum essential coverage for any time during the year.

To receive an exemption, members may apply through the Marketplace, through their tax return submitted to the Internal Revenue Service by April 2015, or members can receive assistance from either Rose Iukes or Brent Case whose contact information is provided earlier in this story. Alternatively, members can access the form at the following website: http://marketplace.cms.gov/getofficialresources/publications-and-articles/tribal-exemption.pdf

If you have health insurance coverage from your employer or if you have other health care coverage (through Medicare, Medicaid, CHIP, VA Health Benefits, or TRICARE), you are covered and don’t need to worry about paying the shared responsibility payment or enrolling for health coverage available through the Health Insurance Marketplace. However, tribal members are encouraged to complete the tribal lifetime exemption regardless of current coverage.

Enrollment

A frequent question arises about enrollment periods. There is no enrollment period or deadline for members of federally recognized tribes and Alaska Native shareholders who can enroll in Marketplace coverage any time of year. Plans can be changed as often as once per month. Be sure to apply no later than the 23rd of the month for benefits to become effective on the first of the following month. Again, see Rose Iukes at the clinic for assistance. Otherwise, information can also be found at the Health Benefit Exchange – Health Plan Finder website: https://www.wahealthplanfinder.org

Insurance Premiums

Premium payment is due by the 23rd of each month for coverage beginning the following month. Payment can be made by echeck or debit card. Recurring payments can only be setup by echeck. Autopay requires an email address. Rose Iukes can assist you with this during enrollment.

Urban Tulalip Tribal Members

The Health Care Authority tribal liaison, Karol Dixon, recommends that enrolled Tulalip tribal members who reside off-reservation, but within Washington state, can access enrollment assistance by telephoning the Tribal Assister at their tribal clinic (Rose Iukes), but if it is more convenient–they can enroll through the HCA website. In fact, all tribal members can enroll there if they choose. At the website, they can locate a Navigator or Broker who can assist them with the process and in selecting a plan. Select the question mark in the top right of the web page to see links to Navigator or Broker at: https://www.wahealthplanfinder.org

Unfortunately, Tulalip members residing outside of Washington are not eligible to enroll through the Washington Healthcare Exchange. They will need to enroll in the state in which they reside. This is disappointing for any members who may be residing in one of the 24 states that have not expanded Medicaid.

Summary

Many American Indians/Alaska Natives are taking advantage of expanded Medicaid as demonstrated by enrollment data reported by the Health Care Exchange. However, enrollment in the Qualified Health Plans, which offer tribal members many tax credits and cost-share exemptions, could be improved. Moreover, the ACA offers American Indians many advantages expanded access and coverage in both Apple Health and the Qualified Health Plans.

Some political and policy questions remain unanswered such as the federal trust responsibility and how that extends to care for tribal elders 65 and over who have no Medicare coverage. One would hope that the ACA’s permanent reauthorization of the Indian Health Care Improvement Act, extending and authorizing new programs and services within the IHS will find a means to address that void in care for our dear elders.

Early enrollment reports from the Health Care Exchange indicate American Indians/Alaska Natives have taken advantage of expanded Medicaid in Washington State. Many of those tribal members were urban Indians who formerly had little access to any health care, so the ACA is proving itself critical to the health services of urban Indians. Those same individuals can also now receive what for many is urgent dental care.

From early indications, the ACA is fulfilling some of its promise in that it is reducing the number of uninsured Americans with more than 8 million Americans enrolling to date. And the number (17,350) of AI/AN enrolled in Washington’s Apple Health (Medicaid) plan as of March 25 seems to indicate the ACA is fulfilling some of its promise to low-income AI/AN and children. Increased tribal enrollment in the marketplace and in expanded Medicaid will free IHS tribal contract dollars for the tribe to utilize for other urgent care needs.

Many political and policy questions remain unanswered relative to trust responsibility and treaty guaranteed expectations. The possibilities of tribal sponsorship have not yet been fully explored. However, in Washington, and at Tulalip, there is a determined effort by many dedicated individuals and organizations to right some of the historic federal oversights in Indian health care.

Kyle Taylor Lucas is a freelance journalist and speaker. She is a member of The Tulalip Tribes and can be reached at KyleTaylorLucas@msn.com / Linkedin: http://www.linkedin.com/in/kyletaylorlucas